Credit Notes and Refunds

Credit Notes

Credit notes, also known as credit memos, are documents issued by a seller to a buyer, reducing the amount the buyer owes to the seller under the terms of an earlier invoice.

When a credit note is issued, the customer receives an email notification with the Invoice # and the amount credited.

Credit Notes are generally used in the following scenarios:

Service Cancellation or Refund: The customer requests a refund because the service was defective, unavailable, did not meet expectations, or failed to deliver promised functionality.

Overbilling: There was an error in the original invoice, such as overbilling or incorrect pricing.

Discounts or Rebates: The seller wants to offer a discount or rebate after the initial invoice was issued.

Promotional Credits: Credits given for promotional purposes or customer satisfaction.

When creating a credit note, you will fill in the following fields:

Effective Date (required): Between the date the invoice was created and the current date

Internal Reason (required): Capture the reason for creating this credit note

Memo (optional): A text note visible to your customer on the invoice

Internal Note (optional): A text note for internal purposes that is NOT visible to the customer

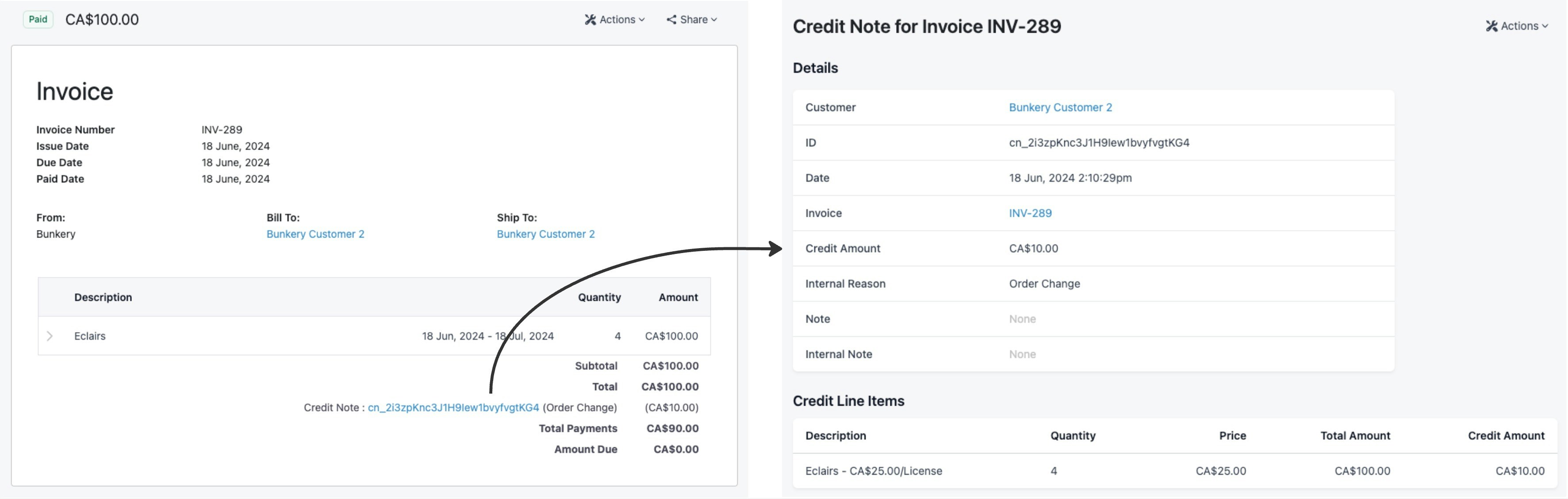

Once created, you can find the Credit Note displayed on the invoice:

Credit Notes vs Refunds

Credit Notes are best used for Invoices that are in

PENDINGandOVERDUERefunds are best used for Invoices that are

PAID